.

Trust in Financial Services on the Rise Globally Amid Economic Uncertainty

The 2025 Edelman Trust Barometer: Insights for Financial Services underscores institutional trust at a standstill globally. The report frames the current global crisis of grievances against institutions—particularly business, government, and the wealthy. This sense of unfairness is tied to economic inequality, fear of misinformation, job insecurity, and discrimination. Yet, amidst this environment, businesses—especially in financial services—remain uniquely positioned to lead positive change. In this year’s report, Financial Services companies are trusted in 17 of the 28 countries surveyed.

Financial Services Remains in the Trusted Category

Financial Services trust globally rose two points in 2025 to 64%. Still, the sector ranks toward the lower end of the 17 sectors measured.

Banking Remains the Most Trusted Subsector

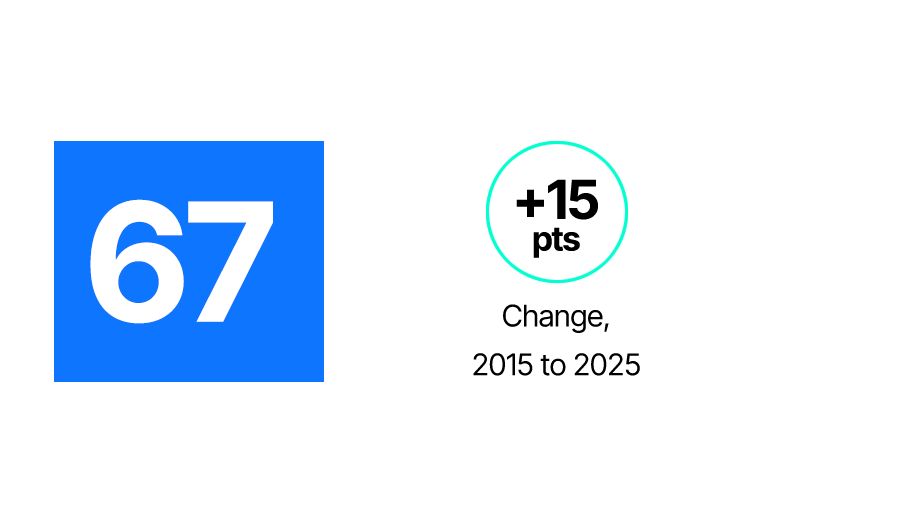

Despite ups and downs, trust in Banking has netted a sharp 15 points since 2015 and has been the most trusted subsector since 2023.

Explore the findings

Restoring Trust and Building Optimism Amid the Crisis of Grievance

1. Grievances Must Be AddressedThe institutional failures of the last 25 years have produced grievances around the world, stifling growth and innovation in turn. To lead through this crisis, understand the economic realities of your stakeholders, champion shared interests, and create opportunities for optimism. |

2. Business Has a Licence to ActThose with a higher sense of grievance are more likely to believe that business is not doing enough to address societal issues. To navigate these expectations, understand where you have obligations, act on behalf of your stakeholders, and advocate for your organization. |

3. Business Can’t Act AloneBusiness, government, media, and NGOs must work together to address the root causes of grievance and enable trust, growth, and prosperity. Invest in local communities, quality information, and job skills. Deliver results that benefit everyone fairly. |

4. With Trust, Optimism Overpowers GrievanceWhen institutions can’t be trusted to do what is right, grievances fester and outlooks darken. To dissipate grievance and increase optimism, prioritize and rebuild trust across your organization and local communities. |

Explore the findings

.

Income and Wealth are Important Factors When Determining Who is Trusted

01

Income-based Trust Gap in Financial Services Persists Globally

⟲

01

The gap between high income individuals (top 25%) and low income (bottom 25%) is 12 points, with high income well into the trusted category (62%) and low income in the neutral category (50%).

02

Low Income Far Less Trusting of Institutions Than High Income

⟲

02

There is double-digit trust inequality in 22 countries based on trust across business, government, media and NGOs. The largest trust gaps are in Thailand (24 pts), Saudi Arabia (21 pts), and UAE (20 pts), compared to US (13 pts) and UK (11 pts).

03

Less Trust in Financial Services Among Low Income and Left-Leaning

⟲

03

While trust in Financial Services companies is high and near equal between men and women and across age groups, trust is in the neutral category globally among low income respondents and those with left-leaning political views.

.

Methodology: The 2025 Edelman Trust Barometer is the firm’s 25th annual Trust survey. The research was produced by the Edelman Trust Institute and consists of 30-minute online interviews conducted between October 25 and November 16, 2024. Learn more >

33,000 | 28 | ±1,150 |